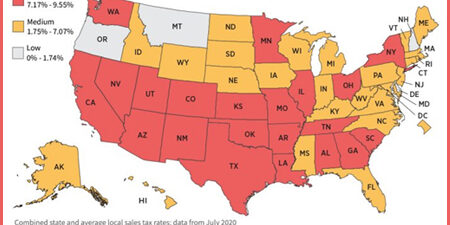

The state with the lowest state sales tax rate is Alaska at 1.76%, well below the national average of 7.12%. After Alaska, the lowest rates are in Hawaii (4.44%), Wyoming (5.34%), Wisconsin (5.43%) and Maine (5.5%).

Muscle Girl Porn | Muscle Girl Webcams [XXX on Steroids] primobolon gujarat: 3 employees of cadila pharma die of covid

On the other end of the spectrum is Tennessee, whose state sales tax rate is the highest in the U.S. at 9.55% followed by Arkansas (9.53%), Louisiana (9.52%), Washington (9.23%) and Alabama (9.22%).

States have to get revenue from somewhere, so states with lower income taxes have often have higher sales taxes. “Tennessee has a very high sales tax but a very low income tax,” says Janelle Cammenga, policy analyst at the Tax Foundation. “In fact, Tennessee doesn’t tax wage income at all — it just taxes dividends and capital gains.” Washington and Texas, which don’t have state income taxes, also have above-average sales taxes.

Some states with low sales taxes, such as Alaska and Montana, get significant income from natural resource taxes. That, too, can have its drawbacks. Alaska, for example, expects to take in $693 million less in taxes in 2020 than it did in 2019, primarily because of declining oil prices.

Overall, the average combined state and local sales tax is 7.12%. City, county and municipal rates vary. These rates are weighted by population to compute an average local tax rate. The sales taxes in Hawaii, New Mexico and South Dakota have broad bases that include many business-to-business services. DC’s rank does not affect states’ ranks, but the figure cited indicates where it would rank if included.